Inspection Contingencies: A TTRPG Realtor’s Quest

Inspection Contingencies: A TTRPG Realtor’s Quest

In the realm of real estate, inspection contingencies can sometimes feel like rolling a d20 to see if the transaction goes off without a hitch or hits a complication. But fear not, fellow adventurers! As the TTRPG Realtor, I’m here to guide you through this quest, equipping you with the knowledge to negotiate inspection contingencies so you can advance to the next stage of your property campaign—whether you’re a buyer, a seller, or a fellow real estate agent!

Below, we’ll explore the fundamentals of inspection contingencies, from the purpose they serve to the negotiation strategies that can tip the balance of power in your favor. Let’s embark on our journey.

Understanding the Inspection Contingency

Imagine the inspection contingency as a powerful protective spell woven into your real estate contract. It grants buyers the ability to investigate a property’s condition before finalizing the purchase. If the inspection unveils any hidden traps (serious defects or safety hazards), the buyer can negotiate repairs, ask for a credit, or—in dire cases—choose to withdraw.

Why Inspection Contingencies Matter

- Shield of Protection: Buyers don’t want to inherit costly repairs they never saw coming. An inspection contingency ensures buyers can step away from a deal if the hazards uncovered are too extreme.

- Negotiation Tool: Once the inspection results are revealed, the buyer can propose new terms—such as requesting the seller fix significant issues or offering a credit to cover repairs.

- Flexibility: If the property’s structural foundation is weaker than a wooden bridge in a monster-infested dungeon, the buyer can exit the contract without losing their earnest money (provided they act within the agreed timeline).

Legal Considerations

From a legal standpoint, skipping or mishandling this contingency can be as disastrous as rolling a natural 1 at a critical moment. Inspection timelines and contractual obligations must be followed to avoid potential lawsuits. Each step must be documented, and all relevant parties (buyer, seller, and any applicable agents or attorneys) should remain informed.

The Inspection Period: Time to Gather Your Party

Once the inspection contingency is in place, the buyer typically has 7–14 days (sometimes longer, sometimes shorter) to assemble their party of inspectors, specialists, or contractors. This window is known as the inspection period. Think of it as an allotted time to gather intel on the fortress (or home) you might soon call your own.

- Scheduling: Promptly schedule a professional inspector. If you’re in a busy market or a bustling city in Texas, it’s wise to line up that inspection quickly.

- Thoroughness: The inspector’s job is to assess every nook and cranny. Just like checking for hidden traps in a video game, they’ll look at the foundation, roof, plumbing, electrical, and more.

- Decisive Actions: Once the report is in your hands, decide how to proceed. Do you want repairs done, a price reduction, or are you satisfied with the property’s condition?

If you fail to complete your inspection or make requests before the inspection period ends, you could lose your chance to negotiate effectively. Staying on top of those contingency deadlines is vital.

Conducting the Property Inspection: Searching for Traps

When the day of the inspection arrives, your hired professional will comb through the property in search of hidden issues. Here’s how the process typically unfolds:

- Initial Walkthrough: The inspector reviews visible components of the home, such as walls, floors, and major appliances.

- Systems Check: They’ll examine mechanical systems like HVAC, plumbing, and electrical to ensure everything functions correctly and to code.

- Exterior Evaluation: The inspector checks the roof, gutters, siding, and foundation for any signs of damage, leaks, or wear.

- Reporting: After they complete the inspection, you receive a detailed report. This document is your “treasure map” revealing every potential pitfall.

Why Expertise Matters

A skilled inspector can mean the difference between identifying a minor side quest (a small leak) and discovering a dragon in the basement (severe foundation damage). Always look for certified inspectors with a track record of thoroughness—particularly in states like Texas, where building standards and codes may differ from other regions.

Interpreting the Inspection Report: Reading the Scrolls

Once you receive the inspection report, treat it like a scroll containing vital knowledge about the property. If you’ve never read one before, they can be dense and filled with industry jargon. Here’s how to break it down:

- Start With the Summary: Most inspection reports highlight critical issues up front. Keep an eye out for words like “immediate attention” or “structural concerns.”

- Focus on Major Repairs: Cosmetic issues (scuffed paint, slightly squeaky doors) are usually less concerning than, say, a failing roof.

- Consult Experts: If you see unfamiliar terms or serious warnings, it may be worth summoning specialists (like a foundation expert or electrician) to give you a second opinion.

- Estimate Costs: If you plan to negotiate repairs or credits, you’ll want a rough cost estimate to back up your requests.

With this knowledge in hand, you can confidently propose new terms—or decide whether to move forward at all.

Negotiation Strategies for Buyers: The Art of Persuasion

Armed with the inspection report, buyers can now make their move. Much like a bard weaving a persuasive story, the key is to strike the right tone when negotiating.

- Identify High-Priority Issues: Emphasize problems that could pose safety risks or require large sums to fix (e.g., plumbing leaks or a damaged roof).

- Request Repairs or Credits: You can ask the seller to fix the issue before closing or provide a credit so you can handle repairs yourself.

- Balance Market Conditions: In a competitive market, buyers might consider waiving or limiting contingencies to sweeten their offer. However, doing so can be risky—be cautious about the potential cost of surprises.

- Set Clear Deadlines: Propose a timeline for the seller to respond. Ensure all requests are put in writing so there’s no confusion later.

When Waiving the Inspection Contingency Makes Sense

Waiving inspection contingencies is like removing your armor before facing the final boss: risky but sometimes advantageous if you’re trying to stand out in a bidding war. If you’ve done a thorough visual assessment or if the home appears to be in excellent condition, you might consider it—but only if you’re comfortable with absorbing any unexpected repairs.

Seller’s Preparation and Response: Defending the Keep

Sellers, you’re not mere bystanders here. You have your own game plan to protect your interests. Here’s how to stay a step ahead:

- Pre-Inspection: Pay for an inspection before listing the property. By fixing or disclosing issues early, you can reduce negotiations later. This move helps you avoid last-minute surprises.

- Consider Repair vs. Credit: If the buyer requests fixes, compare the cost of hiring professionals vs. offering the buyer a credit. A credit might be simpler in some cases, as it lets the buyer handle the repair after closing.

- Stay Transparent: If a major issue arises (like a hidden structural flaw), be honest. Buyers appreciate upfront communication, and it can prevent a deal from crumbling.

Seller’s Market vs. Buyer’s Market

- Seller’s Market: With fewer homes available, sellers often hold more cards. You might stand firm on minimal repairs or credits if you have multiple offers.

- Buyer’s Market: If demand is low, you may need to be more flexible. Buyers have greater leverage to request repairs or credits.

Either way, open communication and a willingness to find a fair compromise usually lead to smoother transactions.

Effective Communication: Your Spell of Persuasion

Negotiating inspection contingencies calls for clear and respectful interaction, much like a skilled mage casting a calming spell over two feuding parties.

- Active Listening: Hear out the other side’s concerns. A buyer might be worried about a sagging roof, while you (the seller) might argue it’s purely cosmetic.

- Stick to the Facts: Rely on the inspection report and professional opinions to support your points. Avoid emotional arguments or speculative claims.

- Compromise Where Possible: If both parties can find common ground, you’re more likely to reach a deal that satisfies everyone. A small concession from each side can keep the transaction on track.

Legal and Market Considerations: Know Your Battlefield

Keeping one eye on legal requirements and the other on prevailing market dynamics is vital. If you fail to meet a contingency deadline, you might forfeit your right to negotiate or even risk losing earnest money. Likewise, local market conditions can heavily influence how you approach contingencies:

- Hot Markets: Buyers might drop or shorten inspection contingencies to entice sellers to accept their offer.

- Slower Markets: Buyers have more wiggle room to demand thorough inspections or multiple specialized inspections.

Regardless of the market’s temperature, staying compliant with real estate laws, abiding by contractual timelines, and avoiding discrimination in any form are all non-negotiable. Fair Housing regulations apply to marketing, negotiations, and every step of the transaction process.

Q&A: Uncovering the Mysteries of Inspection Contingencies

Before our big finale, let’s address some common questions that pop up during this intricate process.

Q1: Can I do the inspection myself to save money?

A: While you might spot some issues, a trained, licensed inspector has the expertise and tools to catch details most of us would miss. It’s generally worth hiring a pro.

Q2: What if the inspection reveals major structural damage?

A: You can negotiate with the seller for repairs or credits. If the damage is extreme and the seller won’t budge, you might walk away, depending on the contract terms.

Q3: Is it common for sellers to refuse to fix anything?

A: It depends on market conditions and the nature of the repairs. Some sellers might opt to provide credits instead of making repairs, especially if the issue is less critical.

Q4: How quickly do I need to respond after getting the inspection report?

A: Typically, you should respond within the inspection period stated in the contract (often 7–14 days). Missing that deadline can limit both your negotiation power and your options.

Q5: Should I waive the inspection contingency if I really want the property?

A: It’s a strategic gamble. If you’re confident about the property’s condition and the market is fiercely competitive, waiving can make your offer more appealing. Just be sure you’re prepared for any hidden repairs that might pop up later.

Q6: How do I find a reputable inspector?

A: Ask for referrals from trusted real estate professionals, friends, or family. Check credentials and reviews to ensure they have a solid reputation.

Conclusion: Charting a Clear Path Forward

Negotiating inspection contingencies is a critical juncture in your real estate campaign. Whether you’re the buyer seeking to protect yourself from any unwelcome surprises, or the seller ensuring your property stands out in the marketplace, utilizing this knowledge is the best way to make an informed decision in a real estate transaction.

Key Points to Remember:

- Understand the Purpose: Inspection contingencies give buyers a safeguard.

- Mind the Timelines: Stay alert to deadlines; missing them can cost you dearly.

- Leverage the Report: Use professional findings to negotiate repairs or credits.

- Communicate Clearly: Transparent, respectful communication keeps the transaction on track.

- Adapt to the Market: Strategies differ between seller’s and buyer’s markets, so stay informed.

By following these steps, you can navigate your inspection contingency negotiations like a seasoned adventurer, avoiding critical fails and setting the stage for a successful closing.

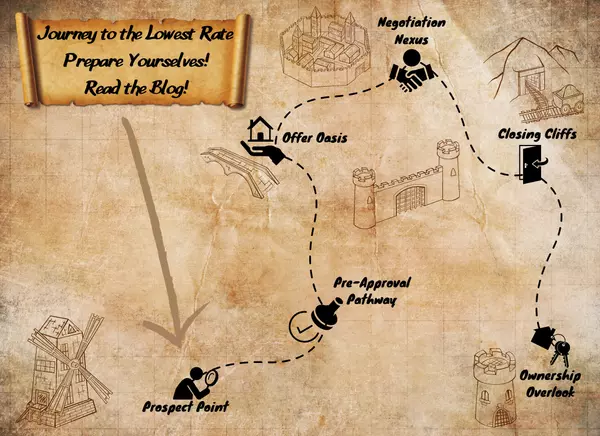

Stay Connected On Your Home Journey With Me!

Whether you’re venturing into your first real estate quest or adding another property to your personal kingdom, I’m here to help you navigate every twist and turn. As your TTRPG Realtor, I bring both real estate expertise and a bit of fantasy flair to keep the journey engaging.

- Questions? Need clarifications or more resources? Reach out at any time.

- Need referrals? I can connect you with inspectors, contractors, or lenders I’ve personally vetted in Texas or beyond.

- Looking to buy or sell? Let’s roll initiative and start strategizing the best path forward to navigate the Texas real estate realms.

- Seeking Additional Knowledge? Feel free to explore my website to read even more real estate blog posts and keep up to date with the latest real estate trends!

- Need Daily Updates? Follow all of my socials to stay up to date with all of the latest real estate trends!

From forging your inspection contingency strategies to finalizing the contract, I’ll stand by your side until you reach the coveted endgame: a successful closing.

References and Resources

- National Association of REALTORS® - Consumer Guide: Home Inspections

- Meadowbrook: Financial Mortgage Bankers Corp. - All You Need to Know About Home Inspections and Home Inspection Contingency

- Houston Association of REALTORS® - Home Inspection Contingency: One Last Critical Check

- U.S. Department of Housing and Urban Development - Property & Unit Inspections Information for Residents (pdf)

Note: This blog is intended for informational purposes and should not be considered professional advice. Always consult with experts for specific guidance.

Categories

Recent Posts